Sunday July 14, 2024

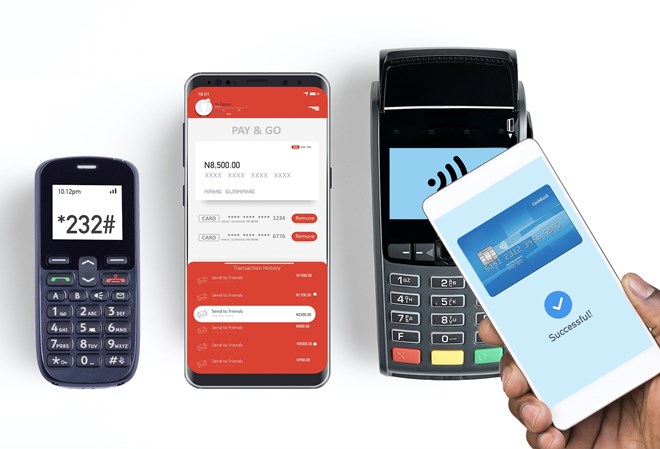

A range of digital payment solutions including mobile money transfers, e-wallets, and card payments, which will be affected by Somalia's newly implemented 5% tax on electronic transactions.

Mogadishu (HOL) — The Somali government's new tax on all electronic sales transactions has sparked widespread concern and discussion among both the public and officials. This tax, initially introduced in 1984 but never enforced due to technical issues, is now fully operational thanks to recent advancements.

Finance Minister Bihi Iman Egeh explained that the government has implemented a modern system to efficiently monitor, track, and assess these taxes. The tax rate is set at 5%, which Egeh claims is lower than in many neighbouring countries, in order to encourage tax compliance among the population. The government has directed telecommunications companies and other digital service providers to work with tax officials to make collection easier.

Digital payment solutions have become increasingly popular in Somalia due to their convenience and the lack of traditional banking infrastructure. Mobile money services, such as Hormuud's EVC Plus and Telesom's ZAAD, dominate the market, with over 70% of the adult population using these services. The new taxation system affects transactions conducted via mobile money transfers, e-wallets, and other electronic payments for both the general public and businesses.

The government has directed telecommunications companies and other digital service providers to cooperate with tax officials to facilitate the collection process.

Abdifitah Dahir Harun, an economics professor at Horseed University in Mogadishu, commented on this tax's potential benefits and drawbacks.

"The government can use the new revenue to invest in economic infrastructure, increasing overall income and reducing dependency on foreign aid," Harun explained. However, he also acknowledged the potential negative impact on the public.

"People's expenses will increase as the tax applies to their final transaction amounts, which might lead to a decrease in the use of these electronic services," he added. The shift could result in a return to cash transactions, reversing the recent growth in digital payments. Such a move could undermine the gains made in financial inclusion and economic efficiency facilitated by widespread mobile money services and digital banking.

The tax's introduction has led to confusion and criticism. MP Dahir Amin Jeesow raised concerns in parliament about the tax's specifics, particularly how it applies to non-commodity transactions like education and healthcare. He questioned, "If I send one dollar to someone, will I be taxed for that? Will it be classified as a purchase? What does this tax mean in practical terms?"

There is also uncertainty about how the tax will apply to non-commodity transactions, such as education and healthcare. "Are we taxing digital payments at hospitals and schools?" Jeesow continued.

Somali Finance Minister Bihi Iman Egeh announces the implementation of a new tax on electronic transactions in a bid to boost government revenue and promote tax compliance.